The Democratic Republic of Congo supplies some 60 percent of the world’s cobalt—a desperately sought after metal that is the driver of our electric vehicle (EV) boom and the fodder of battery giga-factories popping up all over the world.

But this claim to fame is obscured by a much darker side of the DRC – namely that It’s in the middle of a violent uprising and it’s been using inhumane child labor to mine the precious metal. DRC’s cobalt is the ‘blood diamonds’ of this decade.

Buyers are under growing pressure to give up conflict cobalt and find new sources, but the timing is tough. Major automakers and battery manufacturers are scrambling to secure supplies of cobalt. Prices are soaring, and demand can only move in one direction—up.

Here’s why…

Cobalt demand could surge 700% by 2020… and 14,900% by 2030. And smart investors are getting in to position now for the North American cobalt rush.

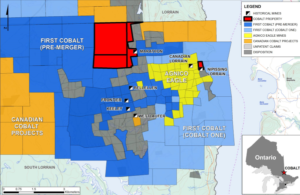

North America has an answer to this, and there is a ‘cobalt rush’ ensuing in a place whose name says it all: Cobalt, Ontario, the site of a silver rush over a century ago.

Back then, just when Cobalt, Ontario was in its silver prime, the doors of African mining opened up wide, and Cobalt was forgotten. A century later, with political instability, war and working conditions that have everyone using conflict cobalt under major scrutiny, miners are coming back to this North American venue in droves.

One little-known company, Quantum Cobalt Corp. (CSE: QBOT) (FRA: 23B) has three projects in the heart of this ‘cobalt rush’ venue. It’s moving fast on exploration, with impressive past-producing mineralizations, and it’s poised to earn its place with a new type of cobalt that is safe, ethical and politically stable.

Here are 5 reasons you may want to keep a close eye on Quantum Cobalt (CSE:QBOT) at a crucial moment when cobalt prices seem to be going in only one direction:

#1 The New Cobalt: It’s North American

Canada is already the world’s second or third biggest producer of cobalt, but it’s only been producing about 6 percent of supply, along with China. Both have been sidelined by the lure of African cobalt. But African cobalt is becoming increasingly shaky, and it’s a supply line that is no longer reliable.

Canada is now ramping up exploration and development, and much of this is happening in Cobalt, Ontario.

Only two years ago, according to one local geologist speaking to Canadian media, “if you had a cobalt property, you couldn’t give it away. All of a sudden, within six months, everything changed.”

What’s changed is that we are using so much cobalt that it’s forced a look at the origins, and that scrutiny is leading consumers away from the DRC.

Even with conflict cobalt, we’re still looking at a potential 20 percent gap in supply by 2025.

So the market is betting big on new cobalt suppliers, and there’s no better place to be than Ontario’s ‘Cobalt Belt’, where Quantum Cobalt has three projects with promising exploration upside.

Fortunes were made here in silver more than a century ago. Now fortunes are about to be made in cobalt.

#2 Quantum Cobalt Plays, Made in North America

Right in the heart of Ontario’s cobalt belt, Quantum Cobalt (CSE:QBOT) has the Nipissing Lorrain Cobalt Project, which has in the past produced over 16,500 tons of the critical metal.

According to the company, the cobalt mineralization here is striking. Past production of five tonnes of material was reported to be an unusually high grade of 22 percent cobalt. That’s impressive when you consider that most projects are deemed valuable with as little as 0.05 percent cobalt, says CEO Greg Burns.

And that’s just one project in this massive cobalt belt. The company has already launched exploration to identify targets in two other projects in the heart of this cobalt belt: Rabbit and Kahuna.

The Rabbit project is just 55 kilometers north of Ontario’s prolific Cobalt district, with historic work returning an assay of 8.76 percent cobalt.

The Kahuna Cobalt-Silver property, covering 77 claims over 1,200 hectares, has also seen mineralization of cobalt discovered in past work.

The company has mobilized field crews to carry out first-pass exploration on both of these properties, and we expect rapid news flow on prospecting, geologic mapping, geochemical mapping, geochemical surveying and sampling to locate and delineate mineralized structures.

Nearby, First Cobalt Corp. (CVE:FCC)—which pulled out of the DRC to expand in safer Canada, has past-producing assets and a market capitalization of CAD$39 million, which is expected to reach CAD$156 million pending an acquisition transaction. It all suggests that 27 Quantum, with its three cobalt projects at ground zero–may be undervalued.

The past production on these properties suggests that 27 Quantum has significant exploration and development potential, and it’s coming into this game right at the edge of the cobalt cliff. And it’s got the team to back it up.

#3 Big Institutional Backing for Veteran Explorers and Value-Creators

Jerry Huwang, a Quantum Cobalt director, is an instrumental player in Energold Drilling Corp., a leading drilling solutions company servicing the mining and energy sectors in the Americas, Africa and Asia. Internationally recognized for social and environmental approach to drilling and operating 270 rigs in 24 countries worldwide, Jerry bring a wealth of knowledge and expertise in exploration and drilling.

CEO Greg Burns, Director of Mergers and Acquisitions at Capital Investment Partners—a multi-billion-dollar fund out of Australia—has lead multiple large-scale deals, including the development of Coalspur Mines into a billion-dollar market cap company at one point.

Quantum Cobalt is also backed by big institutional money, most notably that of Hayward, arguably the most respected institution in Canada. Haywood will be advising on financing and mergers and acquisitions, and it’s already a cleaning house for 4 Canadian dealers with more than CAD$5.5 billion in assets under administration.

#4 Supply and Demand: Gotta Love the Math

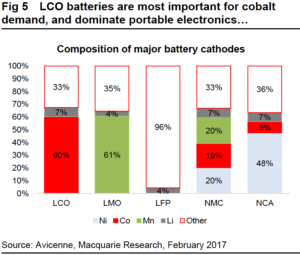

Cobalt makes up some 35 percent of the lithium-ion battery mix. And with 2 million EVs already produced, and numbers rising fast, this critical element is in short supply.

At a price of about $60,000 per metric ton right now—cobalt is the most expensive of all battery metals. And the scramble is on for manufacturers to secure their own cobalt pipeline.

Tesla leads the way, planning to pump out 500,000 EVs a year, and every other major car maker has announced a definitive shift to electric.

- General Motors (NYSE:GM) will launch 20 EV models by 2023

- Renault will double its EV offerings in the next five years

- Germany’s Volkswagen plans to invest more than $24 billion in zero-emissions cars by 2030, producing 3 million EVS a year by 2025.

- VW Group (Volkswagen, Audi, Porsche) plans to invest a whopping $84 billion in EV development (over half going to battery production).

- Ford will release 13 new EV models by 2023.

- Daimler (which owns Mercedes-Benz) is planning 50 models by 2022.

- Volvo is going all electric by 2019 and anticipates selling one million EVs by 2025.

- Renault, Nissan and Mitsubishi, collaboratively, plan to have 12 EVs by 2022.

And battery “giga” factories to support these ambitious production targets are popping up all over the world.

The global lithium-ion battery market—of which cobalt is a critical element—will reach $77.42 billion by 2024.

China will render supply even tighter.

Right now, China is the largest consumer of cobalt in the world. China is by far the largest market for plug-ins, and it’s also the largest producer.

Last year alone, 507,000 EVs and PHEVs were sold in China–a 53 percent increase from 2015, and almost double the number sold in Europe and triple the number sold in the U.S.

In 2016, Chinese cobalt consumption rose by 5.3 percent year-on-year, hitting 45.900 tons—equal to over 44 percent of all global consumption. From this year to 2021, China is expected to see a 12 percent increase in cobalt consumption, on the back of EV and battery growth.

#5 Ontario Loves the Supply Squeeze

The shift is comprehensive. It’s complete. The only thing missing? Cobalt. And investors expect what CNBC calls “inexorable” growth in the EV industry to generate a major supply squeeze for cobalt.

Everyone is scrambling to secure supply, and Cobalt, Ontario, is poised to emerge as a key player.

Volkswagen has just moved to secure long-term supplies of this vital battery component, seeking a 10-year secured pipeline beginning in 2019, according to Reuters.

Volkswagen alone, Reuters estimates, will need more than 150 gigawatt hours of battery capacity every year by 2025 to support its EV plans. It’s enough cobalt for just one carmaker to be labeled one of the largest procurement projects in history. In fact, the total order volume is over $58.7 billion at today’s soaring cobalt prices.

Cobalt spot prices have seen a 150 percent price surge this year.

According to Wood Mackenzie, demand for cobalt in EV batteries alone is expected to grow fourfold by 2020 and 11-fold by 2025. By 2021 already, the supply gap is expected to reach 12,000 tons, according to Research and Markets.

So, with cobalt demand set to surge 700% by 2020… and 14,900% by 2030…

The biggest beneficiaries in this wild market will be smaller, new entrants developing ethical supplies. Right now, that means North America, and Ontario’s Cobalt Belt.

Sitting in the heart of this cobalt belt and surrounded by other fast-moving cobalt miners, Quantum Cobalt (CSE:QBOT) appears to be undervalued in relation to its peers, and it’s got fast-moving exploration boots on the ground.

Honorable mentions:

Global X Lithium ETF (NYSEARCA:LIT) has been around for 7 years, but it’s not a stunning stock story like Tesla. What it is, however, is a safer bet on lithium. There’s not as much to lose here. Year-to-date, LIT is up over 25%, and they remain steady.

This fund has more than $262 million in assets, and it tracks the Solactive Global Lithium Index of companies that engage in lithium mining, refining and battery production. And it gives you exposure to Tesla, as well as to miners like FMC Corp.

General Motors (NYSE:GM) is a household name. GM was born at the turn of the 20th century and has been a leading innovator in the automotive industry ever since. Even though it’s been surpassed in market cap by Tesla (of all companies), it is still the furthest ahead of the Big 3 car makers from Detroit in terms of EVs and self-driving cars.

Recently, GM acquired Cruise Automation—a self-driving car company, and it seems determined to forge ahead even faster to play catch-up with the future. Additionally, GM is a leader in the booming electric vehicle market. As countries across the world begin to pass regulations on combustion engines, GM stands to gain significantly as an early adopter in the EV game.

Fortune Minerals (TSX:FT) is another player in the cobalt space. Operating in Canada’s Northwest Territories, Fortune is eyeing status as a major Canadian producer of battery-grade cobalt chemicals–but it’s also got copper and gold bismuth upside. And it’s getting a boost from the government in terms of mining infrastructure.

Fortune’s modest market cap and low buy in make it a great stock for investors looking to get a piece of the electric vehicle revolution. The company’s value has increased significantly over the past year but it hasn’t yet reached its peak.

Ballard Power Systems (TSE:BLDP; NASDAQ: BLDP) Ballard develops and produces hydrogen fuel cell products for markets such as heavy-duty motive, portable power, material handling and transportation

Ballard’s stock price jumped a whopping 27% in September as the company announced a new way to manufacture fuel cell batteries, reducing the need for platinum in its production process by some 80%.

Ballard expects to start producing the new fuel cells at the end of this year.

While Ballard looks at bit expensive compared to its peers, the stock should be on investors’ radars as this is one of the most exciting fuel cell stocks.

Turquoise Hill Resources (TSX:TRQ; NYSE:TRQ) is a mid-cap Canadian mineral exploration and development company headquartered in Vancouver, British Columbia. Its focus is on the Pacific Rim where it is in the process of developing several large mines

The company mines a diversified set of metals/minerals including Coal, Gold, Copper, Molybdenum, Silver, Rhenium, Uranium, Lead and Zinc. One of the fortes of Turquoise hill is its good relationship with mining giant Rio Tinto.

Going forward, Turquoise’s success at the giant Oyu Tolgoi project in Mongolia will be crucial to boost its lagging share price.

By: Charles Kennedy

Legal Disclaimer/Disclosure:

The above article contains Third-Party Content. All opinions, statements and representations expressed by such third parties are theirs alone and do not express or represent the views and opinions of NNW or its affiliates and owners. Content created by third parties is the sole responsibility of such third parties, and NNW does not endorse, guarantee or make representations concerning the accuracy and completeness of all third-party content. You acknowledge that by NNW providing you with this internet portal that makes accessible to you the ability to view third-party content through the NNW site, NNW does not undertake any obligation to you as a reader of such content or assume any liability relating to such third-party content. NNW expressly disclaims liability relating to such third-party content. NNW and its members, affiliates, successors, assigns, officers, directors, and partners assume no responsibility or liability that may arise from the third-party content, including, but not limited to, responsibility or liability for claims for defamation, libel, slander, infringement, invasion of privacy and publicity rights, fraud, or misrepresentation, or an private right of action under the federal securities laws of the United States or common law. Notwithstanding the foregoing, NNW reserves the right to remove third-party content at any time in its sole discretion. By viewing this third-party content, you acknowledge that you have viewed, read fully, accepted and agreed to all terms of the Disclaimer at http://NNW.fm/Disclaimer.

This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Safehaven.com only and are subject to change without notice. Safehaven.com assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides (1) access to our news aggregation and syndication servers, (2) NetworkNewsBreaks that summarize corporate news and information, (3) enhanced press release services, (4) social media distribution and optimization services, and (5) a full array of corporate communication solutions. As a multifaceted financial news and content distribution company with an extensive team of contributing journalists and writers, NNW is uniquely positioned to best serve private and public companies that desire to reach a wide audience of investors, consumers, journalists and the general public. NNW has an ever-growing distribution network of more than 5,000 key syndication outlets across the country. By cutting through the overload of information in today’s market, NNW brings its clients unparalleled visibility, recognition and brand awareness. NNW is where news, content and information converge.

For more information please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the NetworkNewsWire website applicable to all content provided by NNW, wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

No comments:

Post a Comment